Friday, December 30, 2005

thoughts from real projects

The minimum cost of the integration defines the broadness of the integration market. If the devices to be integrated are less valuable than the cost of the integration, people may not want to integrate them. If the cost of the integration is more than the cost of replacing new devices with popular protocols, the integration will not happen.

Wednesday, December 28, 2005

Smart fridge and food management

I used to buy a lot of thing, put them in the fridge and forget to eat. They ended up at garbage bags. Because once they are in the fridge, I easily lose the awareness of their existence. Everytime I open the frige door, I always pick the things first into my eyes, which are probobally from my latest purchase.

I wish there is a display on the fridge showing me a list where the earliest or nearest to the expire date ones are on the top. It could be a little program in the PC, but again I will forget to open it, which make the program worthless. It must be something on the fridge.

The input method is the hardest part. If I type too much, this program may be abandoned. The easier the input is, the more useful the program will be. The options I can come up are barcode scanning (This way, I should have the same database as the one used by supermaket or setup every new barcode and reuse. Or, web serves?),receipt scanning (This way, the same data could be used for my financial management.) and typing.The first 2 methods require some data re-orgnization process and manual verification. Then, everytime I take something out of the fridge, I have to update it in a convenient way.

Now, let's talk about the management. Each item in the database will be assigned a freshness period or an expire date. Along with the date I put it into the fridge, the program can determine the order of the list. An enhanced funtion could be recommending recipes according to the top items on the list.

Most of the proccssing and calculation can be done in my PC. On the fridge, there are only a LCD display (a touch screen will be too luxury), a commnunication transceiver (most likely wireless) and input devices (scanner and buttons).

Sunday, December 25, 2005

Honeywell to acquire Tridium (December, 2005)

Is Tridium going to become the Microsoft in BA industry? Maybe. Tridum has successfully got its Niagara Framework platform behind many building automation product lines in the market, such as Siemens Steafa Talon system, Honeywell Webs and Invensys I/A series. In September 2005, Johnson Controls launched a new system based on Niagara AX platform called Facility Explorer System. By now, almost every traditional BA giant has at least 1 product line powered by Tridium. And among HVAC manufacturers, CarrierOne Comfort Integrator and Mcquay MicroTech II Chiller System Manager are actually Tridium JACE controllers.

But, wait a minute. How about Echelon, the owner of Lonworks? I figured out years ago, this company want to be BA Intel + BA Microsoft, with Neuron Chip in every Lonworks controller and LNS network operating system in most of the Lonworks networks.

Well, so far, no one dominates the market, because companies learned a lot from IT history and became more and more alert. As a result, on any potential direction, there are more than 1 runner. And existing big players can not afford a single chance of losing the game, they just follow every direction. The game of "de facto standard " is harder and harder.

But they do have difference. Echelon tries to have everybody speak Lonworks, while Tridium accepts all the existing communication protocals including Lonworks and bring them easily on web pages.

The interesting thing here is that this acquisition blurs the line between competitor and partner. Try to replace "Tridium" with "Honeywell" and read the first paragraph again. How do you feel? Will this acquisioin affect Tridium's market presence among Honyewell's competitors after it lose the independency in BA industry? I finally find the answer. Tridium does not care! Its ambition is more than BA and HVAC industry.

Tuesday, December 20, 2005

Johnson Controls plus York

My first impression of this acquisition is like Logitech (a computer peripheral device manufacturer), instead of HP, buying Compaq (a former giant PC manufacturer). But now, I more and more feel this like the merge between AOL and Time Warner in HVAC industry. But ..., I did not mean that this acquisition will repeat the same bad consequence. JCI's current business is much more solid and robust than that of AOL at 2001.

In their presentation to investors (Aug. 25), JCI defined a 200B Building Enviroments market, in which, HVAC controls is 12% of the pie and mechanical equipment is 17%. In fact, it is just a combination of all the neighbour markets that new JCI participates. And personally, I don't see it as a new market unless there are unique products for it, New gargets are somthing I really want to see from this kind of acquisition, as I mentioned in Carrier+AL case. However, both JCI and York are companies over 100 years and in stable markets, technology is often not the priority in business decisions. They are not Google. The math here is 1+1=2.

Where I found 1+1>2 is the oportunities JCI and York penetrate each other's existing customers to sell new controls/mechanical equipment, and more importantly, new combined service. Yes, service is likely the last paradise in this highly competed market. Everybody knows this but how to cook it well is interesting and more difficult. Good luck.

Over all, I am exited to see this combination and looking forward to see more fresh changes in HVAC world.

Thursday, December 15, 2005

A Chilled Water System Analysis Tool

Also, Industrial Energy Conservation Guide looks good. I need some time to read it.

Sunday, December 11, 2005

Johnson Controls to acquire York (August, 2005)

JCI controls sales in 2004 is $6.1B, 23% of the group sales. Controls operating income in 2004 is $284M, 22% of the total (from JCI 2004 Annual Report). York sales in 2004 is $4.5B with operating income of $128M (from York 2004 Annual Report, which is no longer available online).

To read through each company's Form 10K required by SEC is too much for me. But I like the Part I, which gives me a general picture of the companies and the markets.

Here are some of the quotes.

"Key factors in the award of installationcontracts include system and service quality, price, reputation, technology, application engineering capability and construction management expertise."

"Worldwide, approximately 40 percent of the Controls Group's sales are derived from installed control systems and approximately 60 percent originate from its service offerings. Also,approximately 35 percent of segment revenues are derived from the new construction market while 65 percent are derived from the existing buildings market."

"The services market is highly fragmented, with no one company being dominant.Sales of these services are largely dependent upon numerous individual contracts with commercial businesses worldwide and various departments and agencies of the U.S. Federal government."

-JCI

"Products compete on thebasis of product design, reliability, quality, price, efficiency, acoustics, and post-installation service.Architects and engineers play an important part in determining which manufacturer's products will bespecified and ultimately used in an application."

"The global equipment markets are driven by new construction and replacement sales in almost equal proportions."

"Our Global Applied service business competes in a very large but fragmented market, where individualmarket shares are typically in the single digit range. Most of our competition consists of thousands ofindependent mechanical contracting companies delivering services and purchased products. Other competitors include manufacturers such as Trane and Carrier and some non-manufacturing national companies such as Johnson Controls."

-YORK

Saturday, December 03, 2005

Carrier to acquire Automated Logic (April, 2004)

Carrier(CCN), York(ISN) or Trane(TracerSummit), each HVAC manufacturer has its own control system. But most of the systems are mainly sold with their HVAC product. These control systems are more like small islands away from the mainland (BAS market). The aquisition interested me because it was first time that I saw a conventional HVAC player took action in the native BAS market.

The following policies were issued, which I think were to protect each other's market share.

- The United Technologies relationship will reinforce Automated Logic's continuing focus on technology and innovation.

- Carrier Corporation, the acquiring subsidiary of UTC, is committed to the Automated Logic brand and to its independent network of authorized dealers.

- Automated Logic dealers will continue to deliver and service the ALC product line, and Carrier will continue to deliver and service the Carrier CCN product line.

And, what's more? Did they all lived happily ever after? I don't know.

Last year, a Carrier control guy guessed that they may soon have a new thing to replace CarrierOne utilizing the the Bacnet open protocol technology from AL. (CarrierOne is acutally a Tridium JACE controller acts as a gateway between CCN and 3rd party control system) Well, after a year and half, CarrierOne is still there.

It is natural for a technical guy to assume the combination of 2 expertises will bring new gargets, like traditional people believe a marrige will lead to children. The real game is more complicate.

To cheer you up at the end of this boring story, here is a stupid joke. Take a look at CCNWeb, a new HMI for CCN system. Feel the java applets and somewhat "Tridiumized" graphics (especially the AHU one). See, Carrier DO have a child, not from his wife, but his mistress.

Thursday, December 01, 2005

VAV system - installation

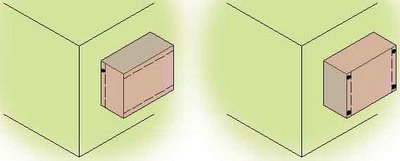

Normally, all the VAV controllers in a project are sent to the VAV supplier. In the factory, an enclosure is mounted on each VAV box. The base of the enclosure contains a transformer and a controller directly coupled to the damper shaft. As showed in the top picture, I've seen 2 types of enclousure (base+cover) so far. The left one is with just 1 screw, pretty difficult to put the cover back. The right one is with 4 screws.

Normally, all the VAV controllers in a project are sent to the VAV supplier. In the factory, an enclosure is mounted on each VAV box. The base of the enclosure contains a transformer and a controller directly coupled to the damper shaft. As showed in the top picture, I've seen 2 types of enclousure (base+cover) so far. The left one is with just 1 screw, pretty difficult to put the cover back. The right one is with 4 screws.In order for site people to see the damper position /check the network connection /replace a controller, the cover of enclosure has to been removed and put back on complishing. A lot of time is wasted without any production. What I suggest is to remove the whole enclosure system and expose the controller, or decrease the size of the inclosure just for the trasformer. Now the design such as the position indicator of the controller is meaningful!.